Toncoin is entering August 2025 with strong bullish undertones, driven by improving technical structure, surging ecosystem activity, and a landmark $558 million institutional buy program.

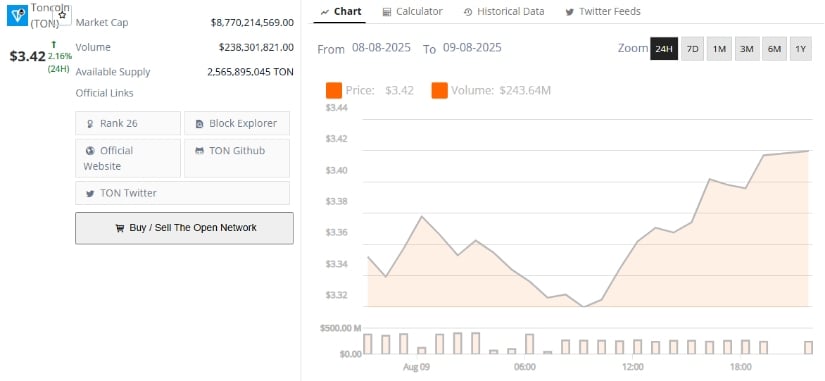

The toncoin price is currently trading between $3.32 and $3.42, marking over 20% monthly gain after rebounding from mid-June lows. Positive developments in DeFi, NFTs, and corporate adoption are fueling speculation that TON could soon test the $4 level.

Toncoin Price Technical Outlook: Support and Breakout Levels

After rallying into the $3.70 zone—a resistance level that capped advances in May—Toncoin faced initial selling pressure but has held firmly above the $3.30–$3.20 support band. This area has seen consistent buying activity, with spot inflows reaching a year-to-date high of $13.35 million on July 31.

Toncoin’s next upside targets are $3.63, $4.20, and $4.68.

Source: ArmanShabanTrading on TradingView

The price structure remains constructive. TON reclaimed key support in June, formed a higher low, and is consolidating under resistance while building momentum. A decisive daily close above $3.63 could open the path toward the psychological $4 mark and potentially extend toward $4.68 if bullish momentum accelerates. Conversely, a drop below $3.20 could shift sentiment and expose the $3.00 level.

Toncoin Price Prediction Scenarios for August 2025

-

Base case ($3.20–$3.90)—Range-bound trading with upward bias, provided buyers continue to defend support and ecosystem news flow remains positive.

-

Bullish breakout ($3.90–$4.68)—A sustained close above $3.70, backed by rising volume and strong follow-through, could trigger a rally toward $4.00 and beyond.

-

Bearish case ($3.20 → $3.00)—Failure to maintain $3.20 support could invite deeper correction, especially if broader market weakness weighs on sentiment.

DeFi Expansion Strengthens Toncoin Price

The TON DeFi ecosystem has expanded significantly, bolstering on-chain liquidity and enhancing Toncoin price stability during volatile markets. STON.fi, the dominant DEX serving over 80% of TON’s DeFi users, secured $9.5 million in Series A funding to boost cross-chain operations and governance features.

TON was trading at around $3.42, up 2.16% in the last 24 hours at press time. Source: Brave New Coin

Yield opportunities on TON-native platforms remain a strong draw, with returns ranging from around 13% to over 60% depending on the protocol and incentive programs. Such capital flows improve liquidity depth and can help sustain bullish market conditions—a key factor for any Toncoin price prediction.

NFTs on TON: Telegram’s Role in Driving Demand

NFT activity on the TON blockchain has surged thanks to Telegram’s native integrations. On June 9, daily NFT trading volume hit $9.7 million, outpacing Ethereum and Solana by a wide margin. Cumulative NFT sales now exceed $300 million, with over two million assets traded.

Features like Telegram Collectible Gifts and the Telegram Stars economy are creating unique user engagement loops that drive sustained demand. This toncoin news highlights how social-native features are turning TON into one of the most active NFT ecosystems.

Institutional Catalyst: VERB’s $558 Million Toncoin Treasury Strategy

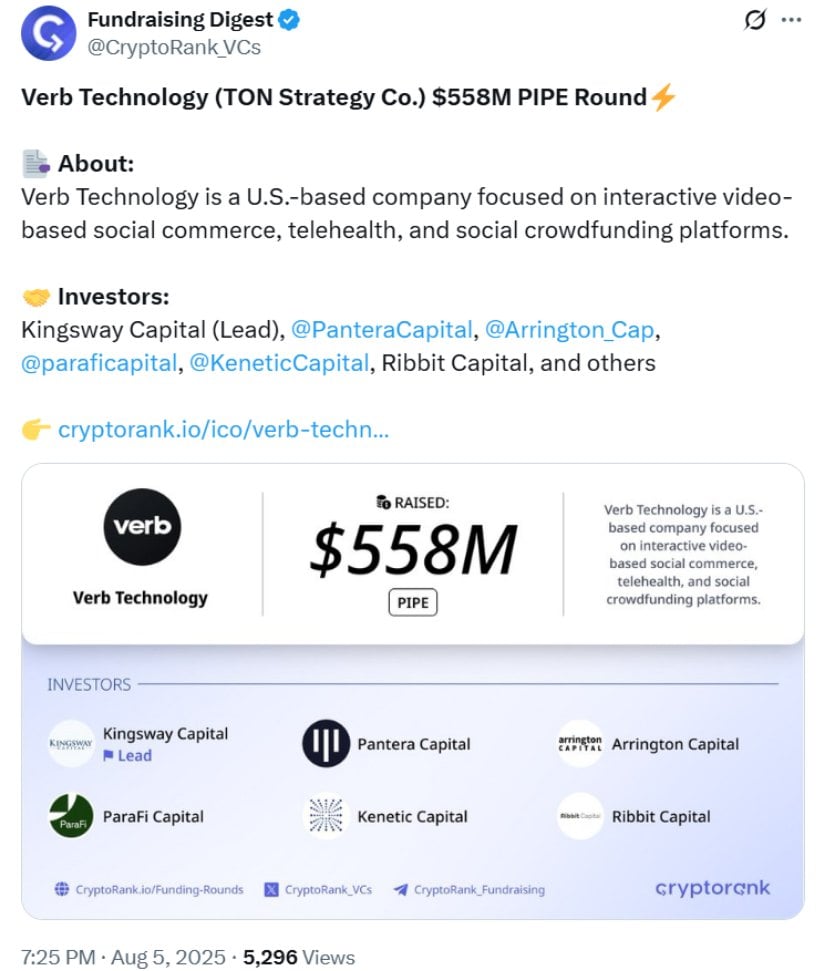

In a major milestone for corporate crypto adoption, Nasdaq-listed Verb Technology closed a $558 million private placement to become the first publicly traded company dedicated to holding Toncoin (TON) as a treasury asset. Backed by over 110 institutional and crypto-native investors—including Kingsway Capital, Vy Capital, Blockchain.com, and Ribbit Capital—the firm plans to acquire and stake TON to generate yield while maintaining exposure to long-term price appreciation.

Verb Technology raised $558M in a PIPE round led by Kingsway Capital with top blockchain investors. Source: @CryptoRank_VCs via X

This strategy could introduce persistent institutional demand and reduce circulating supply over time. As Kingsway founder and TON Foundation president Manuel Stotz put it, “As the exclusive blockchain infrastructure powering Telegram’s Mini App ecosystem, we believe in the utility and potential growth in adoption of Toncoin.”

Looking Ahead: Signals to Watch in August

With the toncoin current price consolidating above $3.40 and multiple bullish catalysts in play, the technical and fundamental outlook remains optimistic. A breakout above $3.70 could confirm the next rally phase toward $4.00–$4.40, while a drop below $3.20 would signal caution.

For traders and investors tracking toncoin price chart trends, key watchpoints include spot volume behavior near resistance, sustained DeFi and NFT momentum, and the pace of institutional accumulation. As ecosystem milestones continue to roll in, the balance of probabilities favors an upside bias in the short term—making August a potentially pivotal month for Toncoin’s market trajectory.