The blockchain landscape in 2025 is a vibrant, yet often fragmented, ecosystem. While innovation continues at a rapid pace, a persistent challenge has been the elusive combination of high performance, true decentralization, and seamless compatibility with the dominant Ethereum Virtual Machine (EVM). Enter Monad Protocol, a Layer 1 blockchain that has swiftly captured the attention of both retail and institutional investors, promising to deliver “Speed without sacrifice” and potentially redefine the boundaries of what’s possible on-chain.

The Genesis of a New Frontier at Monad’s Core Value Proposition

At its core, Monad is a Layer 1 blockchain that works with the EVM and has been carefully designed to deliver performance that has never been seen before. Its main selling point is that it solves the scalability trilemma, which is the natural conflict between decentralization, security, and scalability, especially in the EVM environment. Many systems use sharding or Layer 2 rollups to get more throughput, whereas Monad wants to provide a single, high-performance foundation layer that is fully EVM-compatible.

So, what does it mean? We can see that being compatible with EVM is vital. Developers can effortlessly transition their dApps to Monad, boosting throughput and efficiency without necessitating significant architectural modifications. Users can enjoy a familiar experience with transactions that complete faster and at significantly lower costs.

Question: Why Monad?

Answer: To try something new. pic.twitter.com/2hL2jFzHPS

— Keone Hon ⨀ (@keoneHD) August 24, 2023

Monad’s goal is more than just speed; it wants to open up whole new types of on-chain apps that can’t be built on current EVM chains because of performance issues. Think about high-frequency trading happening in real time on a decentralized exchange, complicated GameFi experiences with rapid interactions, or huge DePIN (Decentralized Physical Infrastructure Networks) apps that need a lot of transactions to work. Monad’s goal is to make these things happen, which would greatly increase the usefulness and range of blockchain technology.

The Strategic View from Institutional Confidence and Ecosystem Growth

Monad Protocol has a strong strategic story for investors, in addition to its technical benefits, backed up by its strong support and growing ecosystem.

Heavyweight Investor Backing & Valuation

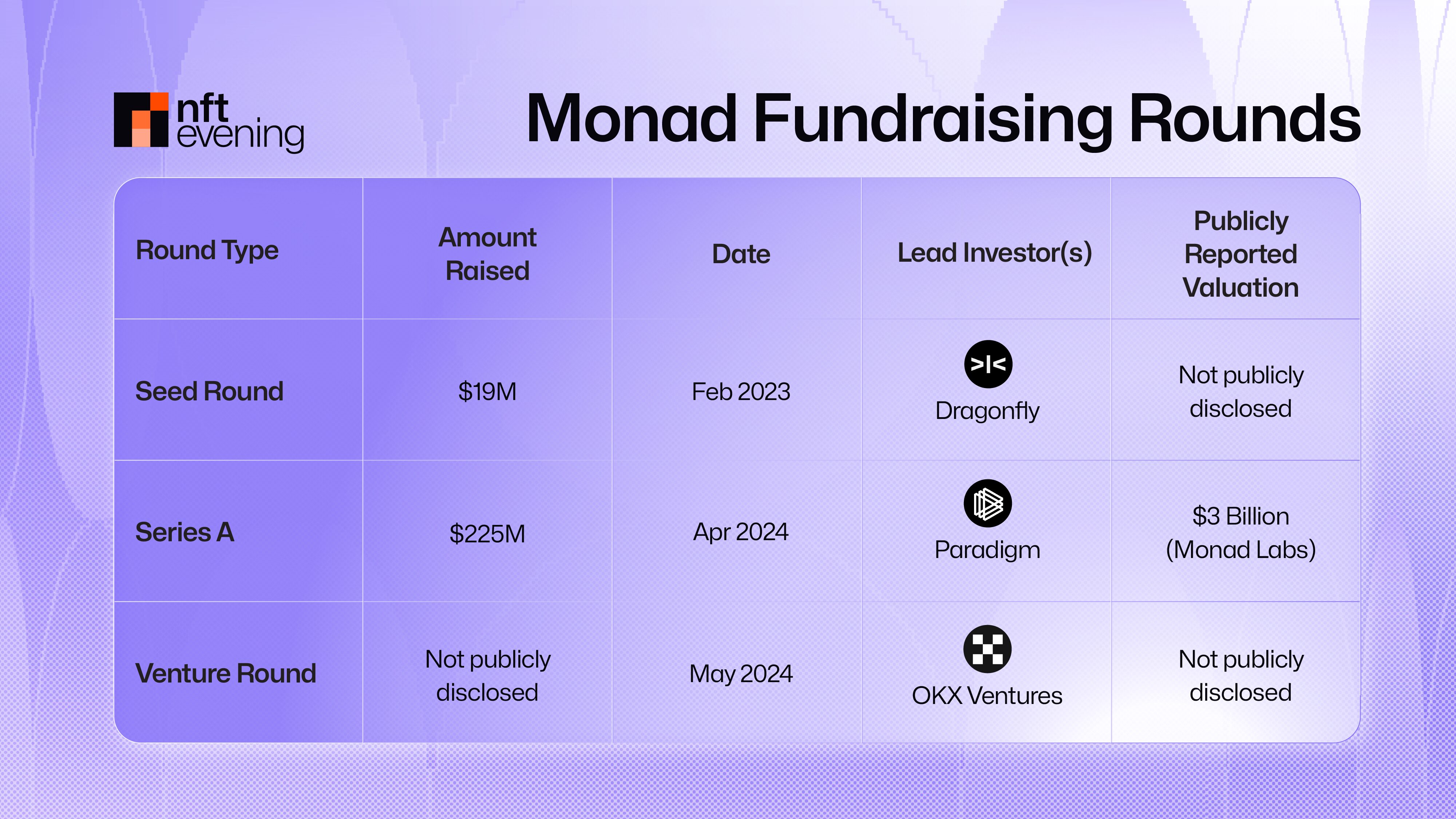

Some of the biggest venture capital firms in the crypto field have put a lot of money into Monad. In February 2023, it got a $19 million seed round from Dragonfly. In April 2024, Paradigm, a huge player in blockchain investing, launched a huge $225 million Series A round. This investment supposedly put Monad Labs’ worth at an incredible $3 billion.

Paradigm Labs and other leading crypto VCs see Monad as a big step forward. In which Monad becomes a unicorn with a post-money value of about $2 billion, according to industry reports. Monad’s technology appears to have the potential to significantly enhance the scalability of blockchains. Furthermore, Monad has a large fund to grow its ecosystem (grants, marketing, tools) without having to worry about token liquidity right away. Investors typically consider Paradigm’s involvement as an indicator of quality and possible network effects.

In May 2024, OKX Ventures also led a funding round for Monad, and Pantera Capital, Electric Capital, Brevan Howard Digital, Coinbase Ventures, CMS Holdings, and others will also be involved. Monad becomes a widely anticipated and well-funded project.

For institutional investors, the strong fundraising and high value show that they have a lot of faith in Monad’s technology and market potential. Top VCs have done a lot of research and are confident that Monad can keep its big promises and take a big portion of the market. Retail investors can take comfort in knowing they are choosing the same projects as “whales.” The idea isn’t just a guess; it has real institutional interest.

Competitive Landscape and Unique Differentiation

There is a lot of competition in the Layer 1 blockchain sector. Well-known companies like Ethereum, Solana, Avalanche, and BNB Chain are already there, and newer companies like Aptos and Sui are trying to get in. So, Monad aims to stand out: offer a better EVM-compatible experience.

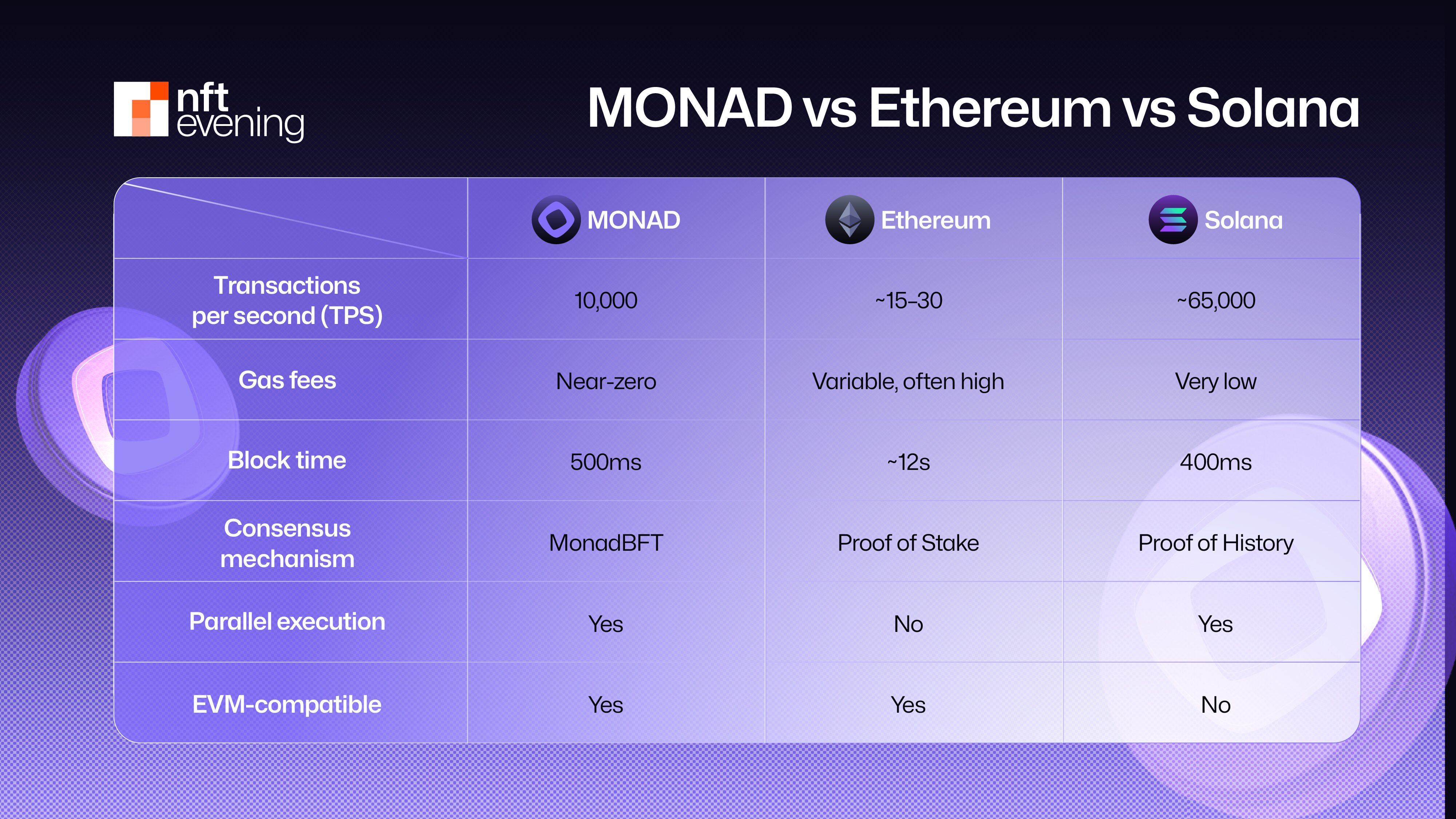

In comparison to Ethereum. Ethereum is still the most popular smart contract platform, but it needs to use Layer 2 solutions because it can’t handle more transactions. Monad wants to provide native, high-performance EVM execution at the base layer, which could make it unnecessary for many applications to use complicated Layer 2 architectures.

Compared to Solana, Solana has high TPS but gives up some decentralization (validators need more powerful hardware) and has had problems with network stability. Monad wants to perform as well as other systems, but with a higher focus on decentralization (through MonadDb’s optimization) and EVM compatibility, which is very important for developers.

When compared to other L1s that work with EVMs, including Avalanche and BNB Chain, these chains work better than Ethereum. However, Monad’s architectural improvements, such as optimistic parallel execution and MonadDb, promise a big jump in throughput and efficiency, which could make them faster than these chains.

Monad’s unique selling point is that it can provide you the best of both worlds: the huge development community and network benefits of EVM, along with a native performance layer that is as good as, and in some ways better than, non-EVM chains.

Ecosystem Growth and Strategic Partnerships

For a blockchain to be successful in the long run, it needs to be able to draw in developers and projects. Reports say that Monad is actively growing its ecosystem, with more than 50 projects now working on the protocol. The fact that 56% of these initiatives are in DeFi, 24% in infrastructure, and 14% in GameFi shows that there is a wide range of interest in important areas.

Chainlink on Monad mainnet day 1@chainlink will unlock data feeds, data streams and CCIP for developers

nads 🤝 marines pic.twitter.com/FGXDVHcICU

— Monad ⨀ (@monad) April 22, 2025

Monad has made smart partnerships with key infrastructure suppliers to strengthen its ecosystem. It is now part of the Chainlink Scale initiative, which gives it access to secure, low-cost, and decentralized data sources. Following this integration, Monad receives Chainlink oracle services like Data Feeds, Data Streams, and the Cross-Chain Interoperability Protocol (CCIP). These services are necessary for integrating data from the real world and making it easy to work with data across chains. In the long term, we could see more DeFi and cross-chain projects to the Monad network.

🐰💜gmonad

🤝PancakeSwap is coming to @monad_xyz

🤤Industry-leading low trading fees, juicy yield farming, and everyone’s favorite IFO

⚡️With v4, expect gas savings and custom pool types, all on Monad’s lightning-fast platform pic.twitter.com/CG3UPj1BLk— PancakeSwap (@PancakeSwap) April 2, 2024

Besides Chainlink, Monad has made other important partnerships. With a TVL of $250 million, PancakeSwap on Monad has become the largest DEX on the network. LayerZero has also improved its communications protocol to work better with Monad’s architecture, which lets transactions happen across chains in less than a second. Wormhole, Balancer, and Curvance are also working together. Any new Layer 1 blockchain needs to form strategic agreements with well-known infrastructure providers like Chainlink and LayerZero. Chainlink serves as a crucial connection to real-world data, essential for intricate DeFi protocols such as lending, derivatives, and prediction markets. LayerZero, on the other hand, makes it simple to transport assets between chains.

Monad <> Layerzero ⚡️

Monad is excited to announce day one @LayerZero_Labs support for seamless asset transfers and connections to 50+ chains!

Stay tuned for more 💜

— Monad ⨀ (@monad) January 16, 2024

These aren’t just partnerships for advertising; they’re core connections that make the whole Monad ecosystem work better, be safer, and have more liquidity. The strong TVL on PancakeSwap shows that the technical architecture is effectively enabling real-world financial activity, which is a positive sign of early liquidity and user interest. From investors points of view, the blockchain is setting a goal to establish a strong, interconnected environment from the ground up, not just to focus on speed.

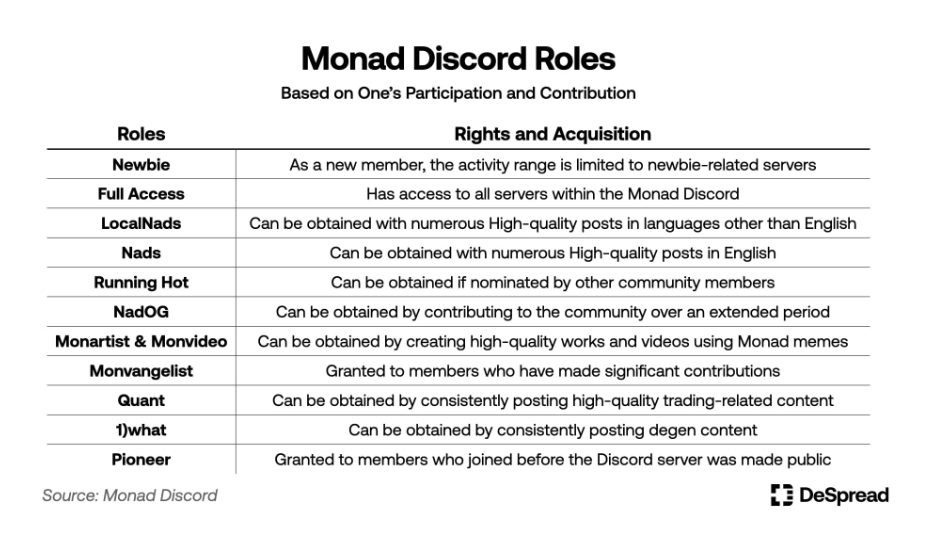

The active community, which includes more than 280,000 Twitter followers and 297,000 Discord members, shows that there is a lot of interest in retail and that it is a good place for future adoption.

Source: DeSpread

Investment Outlook with Opportunities and Risks

Opportunities

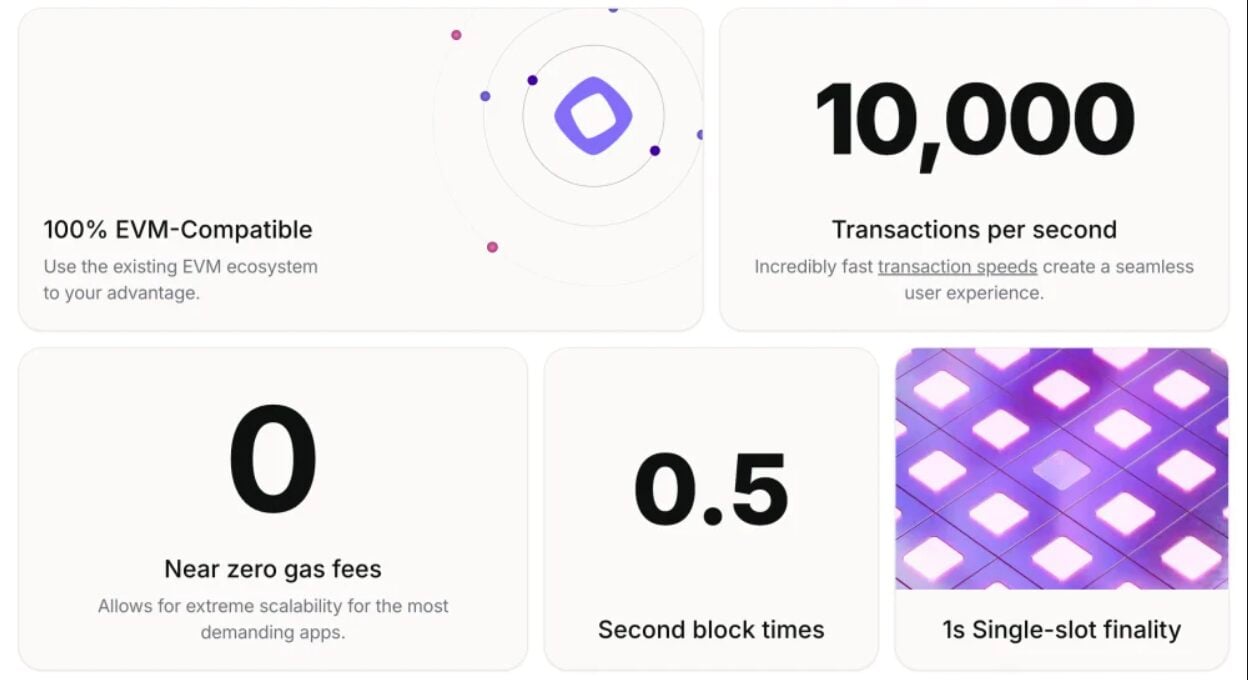

There are several important reasons why Monad is a great investment opportunity. Its huge scalability, with 10,000 TPS and 1-second finality, opens the door for a new generation of dApps like high-frequency DeFi, real-time gaming, and enterprise blockchain solutions. As a consequence, TVL will increase as well as the transaction volume.

Moreover, Ethereum’s full EVM compatibility provides a strategic advantage, simplifying the start-up process for developers and users. With a high-speed blockchain like Monad, the adoption speed is boosted, and the growth of a diversified ecosystem is supported by making use of existing talent and liquidity.

Source: Monad

Well-known venture capitalists such as Paradigm and Dragonfly have provided strong institutional support, bolstered by a reported $3 billion valuation. They have a long-term commitment to the project and will provide robust financial support. Vice versa, the company can build a solid base for future growth, marketing efforts, and ecosystem incentives.

If Monad can keep its technical promises, it might become the most popular EVM application, drawing in a lot of money and expertise from other chains. Finally, even if certain details are still coming out, the native token utility as a Layer 1 will probably include gas fees, staking, and governance. More people using the network and adopting it would directly raise the demand and value of the token.

Risks Considered

Monad has a lot of potential, but investors also need to think about the hazards that come with it. Execution risk and technological problems are major concerns: Monad’s big promises, especially about optimistic parallel execution and getting 10,000 TPS with 1-second finality, are hard to understand from a technical point of view. It is quite hard to make a mainnet that is reliable, safe, and fast in the real world. Any major defects, security holes, or failure to reach performance goals might seriously hurt trust and make it harder for people to use the product.

Monad also has to compete with well-known companies and Layer 2 solutions that are already on the market. Ethereum is always changing, and other high-performance Layer 1s like Solana, Aptos, and Sui are always getting better. Not only does Monad have to keep its promises, but it also has to keep coming up with new ideas to set itself apart and convince developers to select it over battle-tested options or the Layer 2 ecosystem, which is getting better all the time.

Adoption and network effects are another big problem. Developers need to keep working on tools, community support, and creating compelling use cases to turn a lot of investor interest into significant adoption by users and other developers.

Source: Monad

Monad wants “speed without sacrifice”; however, there are always trade-offs between decentralization and performance. For any monolithic blockchain, making sure that it is truly decentralized and resistant to censorship at very high throughput levels is always a challenge. Investors should closely monitor the distribution of validators and the hardware requirements. Finally, as the cryptocurrency market grows up, regulators are paying more attention to it. Any negative changes in regulations affecting Layer 1s or specific blockchain technologies could significantly harm Monad’s business and its reputation within the industry.

A Bet on the Future of EVM That Makes Sense

In the blockchain arena, Monad Protocol is a planned investment that could pay off big time. It has a lot of new technical features, like optimistic parallel execution and MonadBFT, that make it a strong candidate to lead the next wave of high-performance EVM-compatible Layer 1s. The project has a lot of potential because it has a lot of support from top-tier venture capitalists, a quickly growing ecosystem, and a very experienced team that has worked in high-frequency trading.

Monad gives both retail and institutional investors a chance to participate in a project that aims to tackle one of the biggest problems in blockchain: performance that can be scaled, decentralized, and compatible with the Ethereum Virtual Machine. There are still risks that come with new technologies, but Monad’s proactive approach to innovation and its strategic market positioning make it a project that should be given serious thought as the blockchain world moves toward a future where decentralized applications are widely used in 2025 and beyond. If it works, it might open up a whole new world of on-chain features that would change the way we use the decentralized web.