TLDR

- Prediction markets now show a 15-16% chance of a 50 basis point Fed rate cut on September 17, up from zero chance last Friday

- Bitcoin trades above $113,750 with 2% gains as total crypto market cap reaches $3.88 trillion

- Altseason indicators hit highest levels since December, with altcoin season index reaching 76 out of 100

- Total altcoin market cap approaches 2021 all-time high at $1.63 trillion, nearing the $1.64 trillion peak from November 2024

- Top altcoin performers include Dogecoin (+5%) and Avalanche (+11%) over the past 24 hours

The Federal Reserve’s upcoming September 17 meeting has sparked renewed optimism in cryptocurrency markets as prediction markets now price in a 20% chance of an aggressive 50 basis point rate cut. This marks a dramatic shift from just one week ago when such a possibility was not even considered.

💥BREAKING:

ODDS OF 50BPS RATE CUT IN SEPTEMBER HIT 20%. pic.twitter.com/ZKFid0w4w7

— Crypto Rover (@rovercrc) September 10, 2025

The CME Group’s FedWatch tool shows a nearly 10% chance for a new target rate of 375-400 basis points following the meeting. Before September 5, markets were only pricing in the widely expected 25 basis point cut to a target range of 400-425 basis points.

Leading prediction markets Kalshi and Polymarket reflect similar sentiment. Kalshi traders are pricing a 16% chance of a cut higher than 25 basis points, with over $41 million in trading volume. Polymarket shows a 15.3% chance of a 50 basis point cut with $91 million in accumulated bets.

The shift in expectations comes after recent economic data including PPI figures at 2.6% against previous and expected 3.3%. Jobs reports and other adjustments have contributed to the sudden change in market sentiment toward more aggressive monetary easing.

Interest rate cuts typically benefit risk assets like cryptocurrencies by rotating capital away from treasury bonds toward higher-yield opportunities. The Federal Reserve under Jerome Powell has shown reluctance to cut rates since the last reduction in December 2024.

Bitcoin is currently trading above $113,750, gaining 2% from its September 8 closing price of $111,500. The total cryptocurrency market cap has reached $3.88 trillion, up 1.5% from the previous day’s $3.82 trillion close.

Altseason Indicators Reach Peak Levels

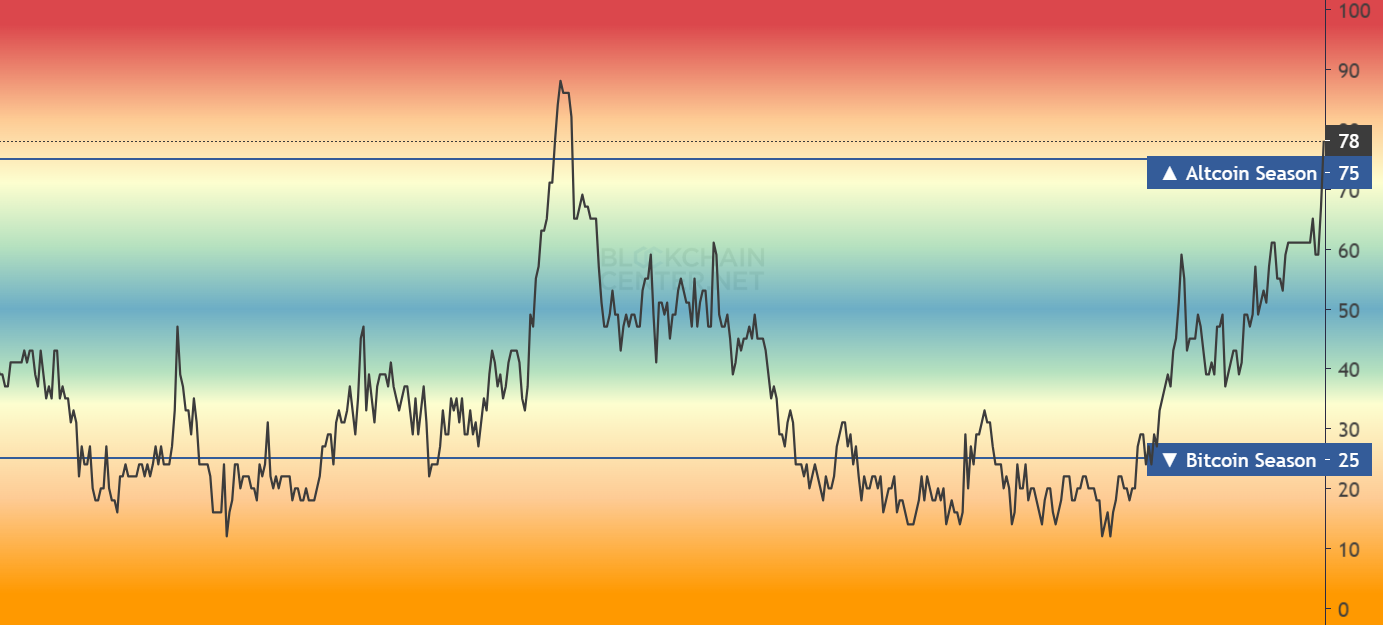

Altseason indicators have surged to their highest levels since December, with multiple metrics showing strong altcoin performance relative to Bitcoin. The Blockchain Center and CoinGlass altcoin season index both show a score of 76 out of 100, while CoinMarketCap’s indicator registers 67.

The Blockchain Center defines altseason as when 75% of the top 50 crypto assets outperform Bitcoin over a 90-day period. Current readings suggest this threshold has been reached for the first time since late 2024.

Total altcoin market capitalization excluding Bitcoin and stablecoins stands at $1.63 trillion, approaching the 2021 all-time high. The previous peak was $1.64 trillion in November 2024, and before that, $1.7 trillion in November 2021.

Recent price action shows Bitcoin’s market dominance declining as altcoins gain market share. This decoupling typically intensifies during bull markets, potentially signaling the start of a broader altcoin rally.

Market Performance and Outlook

Top-performing altcoins over the past 24 hours include Dogecoin, which gained more than 5% to reach $0.25, and Avalanche, which surged almost 11% to $29. This represents Avalanche’s highest level since January.

Other strong performers include Hyperliquid, Stellar, Litecoin, and Toncoin, all gaining more than 3% in the past day. These gains reflect the broader trend of capital flowing into alternative cryptocurrencies.

Tether’s unusual $2 billion USDT mint, the first since December 2024, adds to the bullish sentiment. This mint coincided with the last Fed rate cut, suggesting institutional preparation for increased market activity.

The Federal Reserve’s September 17 decision will likely determine whether current momentum continues, with a 50 basis point cut potentially accelerating the altcoin rally that market indicators suggest is already underway.