As of August 27, 2025, the Arbitrum ecosystem is running with deep, steady liquidity and busy execution.

Arbitrum Blockchain In General

Tracked data from DeFiLlama shows the stablecoin market cap of Arbitrum is around $3.44B, with USDC nearing 58%. DEX spot volume sits at ~$1.00B for 24h and ~$6.68B for 7d, while perpetuals post ~$1.12B for 24h and ~$6.44B for 7d. Daily activity is healthy too, with ~470K active addresses and ~3.4M transactions on the day of this snapshot. These baselines let us pick leaders by real usage instead of only community buzz. Figures below are live-data snapshots; crypto markets move fast.

Source: DefiLlama

Arbitrum Spot DEX (AMM & Aggregated Liquidity)

On Arbitrum’s DEX leaderboard, Uniswap dominates daily flow. The chain’s DEX-by-protocol table shows Uniswap at ~$691 (24h), followed by Camelot at ~$76M, Fluid at ~$66M, PancakeSwap at ~$62M, and Curve ~$18.86M. In other words, Uniswap alone clears roughly 70% of Arbitrum’s day volume, and the top five together hold north of a 90% share. The graph shows a strong sign that most routes converge through a few deep venues.

Source: DefiLlama

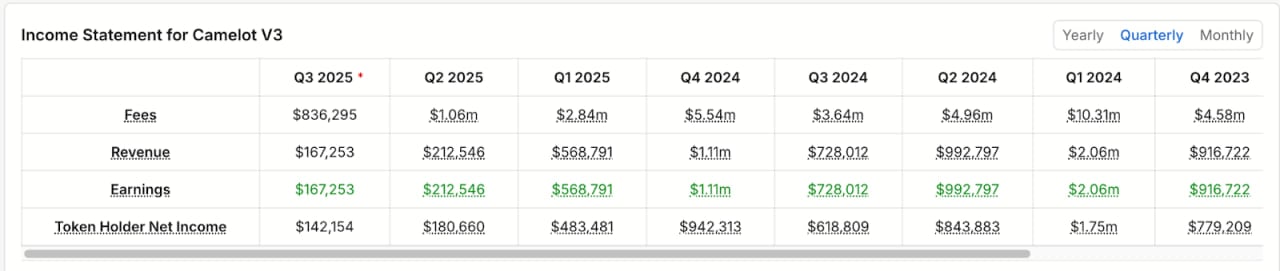

Depth on “home-chain” infra matters, and Camelot plays that role. Its v3 stats show ~$2.04B 30-day DEX volume, ~$513M 7-day, and ~$76M 24-hour across recent snapshots—enough throughput to stay relevant as native liquidity even while Uniswap leads aggregate routing.

Source: DefiLlama

Fees and revenue are also visible, giving a signal on taker activity and protocol capture. We highlight Uniswap, Camelot, Fluid, PancakeSwap, and Curve here because together they explain almost the entire day’s trading on Arbitrum.

For more: Arbitrum Price Prediction 2025: Heavy Sell Pressure is Waiting

Arbitrum Perpetuals & Derivatives DEX

Arbitrum’s perps tape is lively. The perps-by-chain dashboard shows ~$1.11B 24-hour and ~$20.7B 30-day volume at our snapshot time; across nearby reads during the day, it ranges into the $1.5B zone as markets heat up. That’s a durable engine for sequencer fees and protocol revenue. The leaderboard on this panel puts GMX at the front on Arbitrum, with Orderly, Rho, Aark Digital, and Gains Network in the next slots—evidence that 2025 is no longer a single-venue story. Our selection is driven by visible ranking and consistent share through the week, not just brand recall.

Source: DefiLlama

To frame magnitude, GMX’s protocol page (all chains combined) often shows hundreds of millions in 24h perps volume and several billions over 30 days, aligning with the chain-level numbers above and supporting the idea that perps are a primary flow driver on Arbitrum. Exact splits vary by hour, but the totals confirm the sector’s weight.

Source: DefiLlama

Furthermore, according to Launchy data in 2024, GMX ranked itself in the top perpetual exchanges trading volume behind a wide range of perp DEXs in the crypto market.

Source: DefiLlama

Arbitrum Lending & Money Markets

Aave v3 dominates lending on Arbitrum by TVL. The lending rankings filtered to Arbitrum show Aave v3 ~$1.24B TVL, then Compound v3 ~$173M, Fluid Lending ~$128M, Dolomite ~$92M, and Silo ~$24M. Total lending TVL on Arbitrum is ~$1.73B, so Aave’s share is roughly 65% on this snapshot—high enough that Aave’s risk parameters often anchor the chain’s base borrow rates.

Source: DefiLlama

Source: DefiLlama

We pick these five because they are literally the top of the Arbitrum lending board by TVL and represent different designs: blue-chip pooled markets (Aave, Compound), Instadapp’s integrated model (Fluid), advanced margin mechanics (Dolomite), and isolated risk silos (Silo).

Beyond TVL, revenue matters. Dolomite’s protocol page shows ~$166.7K in revenue over the last 30 days and ~$780K in 30-day fees at the time of check—clear evidence of paying users rather than only idle collateral. That operational signal is why it’s on the short list despite a smaller TVL than Aave and Compound.

For more: A Deep Dive into the Base Ecosystem

Arbitrum Options & Structured Products

Options on Arbitrum are smaller than perps but fill the hedge/income niche. Five names deserve focus:

- Stryke (formerly Dopex): the long-running Arbitrum native options brand, now rebranded and iterating on LP/option mechanics. The team formalized the move from Dopex to Stryke in its announcement.

- Lyra / Derive: Lyra’s Newport deployment brought Arbitrum support and uses GMX perps to delta-hedge options portfolios, improving capital efficiency for its MMV strategies. The proposal and community notes outline the GMX-based hedge design.

Source: Messari

- Premia: active on Arbitrum and documented in the DAO forum through incentive and education threads tied to Arbitrum users.

- Rysk Finance: known for AMM/OB experiments and structured options; historical notional runs into the hundreds of millions, although liquidity has shifted chains at times in 2025. Rysk’s selection here is for historical footprint and product design breadth.

- JonesDAO: strategy vaults that have historically tied into GMX (e.g., jGLP, jUSDC) and structured yield. Forum posts and docs capture how those vaults worked and grew during incentive programs.

Over the past few days, $jUSDC has become a top 5 token market on @Dolomite_io 🏔️

With over 2.3M jUSDC in supplied liquidity, there is only a little bit of room left!

Use Dolomite to earn STIP incentives & borrow against your tokens at the same time 🤠 pic.twitter.com/fahdOGjGTl

— Jones (@JonesDAO_io) January 14, 2024

We emphasize these five because they shaped options usage on Arbitrum and still anchor how traders hedge or farm carry here, even as newer names rotate into leaderboards.

Arbitrum Yield & LSDfi / Yield Derivatives

Pendle is the clear headline for yield markets that tokenize and trade future yield. Its protocol page shows ~$10.87B TVL, ~$788M 7-day DEX volume, and ~$5.81B 30-day DEX volume across chains at our snapshot. On Arbitrum specifically, Pendle reports ~$59.6M TVL, which is meaningful given the chain’s base of LSD/LRT collateral and the presence of auto-compounders. We select Pendle because it concentrates the “future yield” order flow and posts consistent volumes week after week.

Beefy Finance complements that stack on Arbitrum with long-standing vault deployment (live since 2021) and ongoing vault coverage, giving users one-click access to compounding strategies tied to the local pool set. This matters because vault infra plus LSD collateral is what turns base liquidity into usable, tradable yield legs for Pendle and others.

Source: Aave v3

A key “plumbing” fact underneath those strategies is wstETH. wstETH is active on Aave v3 Arbitrum. The market shows ~36.2K wstETH supplied with ~4.3K borrowed on Aug 27, 2025, with about $201M supplied and $24M borrowed at the oracle price on the page. This keeps LSD/LRT-based loops practical on Arbitrum without excessive rate slippage.

For more: Fixed Yield DeFi vs. Traditional Fixed Income in Yield Farming Rewards

Bridges & Liquidity Transport

Arbitrum’s TVL and volumes rely on cheap, fast bridges. Two names that stand out are Across and Stargate.

The first one, Across, is a cross-chain bridge, bridging from l2 to l1 and a cross-L2 bridge that is consistently near the top of bridge leaderboards. DeFiLlama shows ~$23.7B cumulative bridge volume, while the project’s own Q2 2025 update reported “$27.5B+ bridged, 17.3M transfers, 4M+ users.” The difference reflects live updates and methodology across data sources; both point the same way. The Across is bridging a very large scale. We choose Across for its throughput, user count, and time-to-fill metrics that make it a common “ingress” for traders.

Source: DefiLlama

The second one, Stargate, has a unified liquidity design and broad exchange coverage that keeps it a staple route for funds into Arbitrum. DeFiLlama tracks its TVL and flows; industry snapshots through 2025 still cite Stargate as a top bridge by liquidity and usage. We include it because desks and end users continue to rely on it for stablecoin transfers.

2025 Arbitrum Activity Highlights

The perps lane remains the fee engine. The chain panel shows perps at ~$1.12B 24h / ~$6.44B 7d, with intra-day reads sliding toward $1.5B as volatility picks up. That supports our selection of GMX plus newer perps (Orderly, Aark, Ostium, Gains) that now share the tape.

Spot DEX flow holds steady at ~$1.0B/day and ~$6.7B/week, with Uniswap clearing most of that on Arbitrum and Camelot anchoring native pairs. Camelot’s ~$2.04B 30-day volume shows why it stays in the top five despite Uniswap’s lead.

In lending, Aave v3 at ~$1.11B TVL keeps roughly two-thirds of the market on Arbitrum, while challengers like Compound v3, Fluid, Dolomite, and Silo fill the rest. The Dolomite ~$185K 30-day revenue print is an extra proof that competition is pushing for fee-earning usage rather than only TVL mining.

On yield, Pendle continues to be a “liquidity machine” for future-yield trading, showing ~$788M 7-day DEX volume at this snapshot, and wstETH on Aave v3 Arbitrum provides the base leg many strategies need. Beefy has been present since 2021, giving convenience wrappers that keep retail flow in the game.

For bridging, Across is the high-frequency route with tens of billions in lifetime volume and millions of transfers, and Stargate retains broad liquidity and coverage. These pipes are the reason the downstream sectors above keep humming.

Conclusion

Arbitrum’s DeFi main sectors in 2025 look liquid, busy, and broader than a year ago. In general, we could see that Arbitrum is healthier and more diversified. There is a wide range of upside tied to continued bridge throughput, perpetual competition, and LSD adoption. While key risks of protocol TVL and usage centralization still exist in the Arbitrum ecosystem, the liquidity shifts as incentives and strategic moves of the ecosystem can help Arbitrum go back to balance and reach a new height.