The crypto market is up today, with the cryptocurrency market capitalization increasing 1.1% and back to $4.16 trillion. Most of the top 100 coins have appreciated over the past 24 hours. At the same time, the total crypto trading volume is at $146 billion.

Crypto Winners & Losers

At the time of writing, nine of the top 10 coins per market capitalization have decreased over the past 24 hours.

Bitcoin (BTC) rose 1.2% at the time of writing, currently trading at $117,255. This is among the highest increases in this category.

Ethereum (ETH) is up 0.9%, now changing hands at $4,544.

The highest increase is 2.8% by Binance Coin (BNB). It currently trades at $954.

XRP recorded the second-highest rise of 1.5% to $3.02.

The only coin that stands in the red is Tron (TRX), having dropped by 1.1% to the price of $0.3419.

When it comes to the top 100 coins, 16 coins are red. The highest among these is 5.1% by Pump.fun (PUMP), trading at $0.007873.

It’s followed by Provenance Blockchain (HASH)’s 2.4% to $0.03672.

On the other side, the biggest gainer today is MYX Finance (MYX), having appreciated 43.2% to $15.65.

Sky (SKY) is the only other coin with a double-digit rise: 10.5% to $0.07635.

Meanwhile, the Ether Machine, an Ethereum-focused treasury management firm, has filed a draft registration statement with the US Securities and Exchange Commission (SEC), seeking to go public via a SPAC merger with Dynamix Corporation.

‘Lower Interest Rates May Lead to Increased Prices of the Major Blue-Chip Coins’

On 17 September, the US Federal Reserve will announce the latest rate decision, with markets widely expecting a 25 basis point cut, Bitunix analysts say.

They argue that, “traders are advised to manage leverage carefully and watch BTC’s key technical levels: resistance at 117,000 and support at 115,000. A dovish outcome could propel BTC toward the 118,000 liquidation zone, while a hawkish tilt could trigger a sharp pullback.”

Karel Kubat, co-founder and CEO at Union Labs, explains that “if history is any guide, markets tend to show strength for up to a year after the Fed’s first rate cut, but that doesn’t mean there won’t be volatility immediately around the policy change.”

“What matters for crypto now is not just the macro tailwinds, but whether the current and future state of infrastructure, composability, and interoperability can support renewed capital flows without risking fragmentation or instability. These are often understated, but they’re essential requirements for institutional money to enter and move at scale,” Kubat concludes.

Yet, Samantha Bohbot, Partner and Chief Growth Officer at RockawayX, noted that the FOMC meeting may be “less about a surprising FED decision, but more about [Chairman Jerome] Powell’s comments.” Any hawkish comments might lead to repricing and a sell-off.

“In such an uncertain environment, it is often good to either accept the increased volatility for high conviction bets or decrease the investment exposure around the event,” she says. “Decreasing exposure only introduces the opportunity cost of not being fully in the market in the case of a positive surprise. It also gives an investor more dry powder to deploy during the sell-off at a more reasonable price. We see the hedging with options as too costly, as the volatility is usually priced in.”

Bohbot continues: “Lower interest rates increase the liquidity in circulation, and investors deploy capital into more risky assets such as stocks and crypto. This should lead to increased prices of the major blue-chip crypto assets such as BTC, ETH, and SOL, where BTC is the asset that is influenced by liquidity outlooks the most.”

Levels & Events to Watch Next

At the time of writing on Wednesday morning, BTC trades at $117,255. There was a surge earlier in the day from the intraday low of $114,866 to the intraday high of $117,292.

The coin is back in green across the 24-hour, 7-day, and 1-month timeframes. It may now continue to climb, surpassing $118,500 and potentially moving to $120,000. Conversely, a drop below $116,000 may lead it bac down to the $114,000 zone.

Ethereum is currently trading at $4,544. It initially fell from $4,509 to the low of $4,431, before jumping to the intraday high of $4,553.

It has outperformed BTC in the 1-month time frame: 6.2% compared to 1.5%.

Investors are now looking to see if the price will move below $4,430 and potentially into the $4,350 area, or if it will continue rising above $4,550 and towards $4,600.

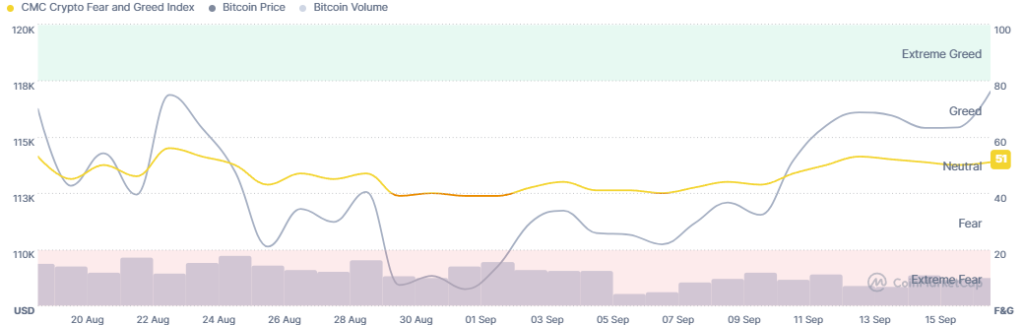

Meanwhile, the crypto market sentiment has remained mostly unchanged over the past few days. The crypto fear and greed index moves between 50 and 53, standing at 51 today.

It’s clear that the market is waiting for further economic and geopolitical signals, particularly with the upcoming US rate cut decisions set for today.

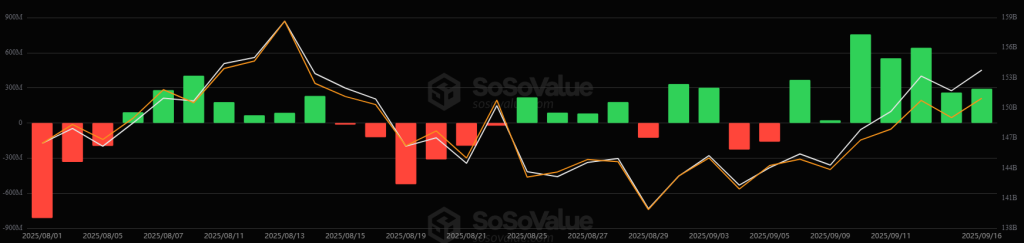

Moreover, the US BTC spot exchange-traded funds (ETFs) recorded the 7th day of inflows on Tuesday, of $292.27 million. The cumulative net inflow has now reached $57.38 billion.

Four of the 12 ETFs saw inflows, and one recorded outflows. BlackRock is responsible for the large majority of the day’s positive flows, taking in $209.18 million. At the same time, Bitwise let go of $10.78 million. This is a nearly identical situation to yesterday.

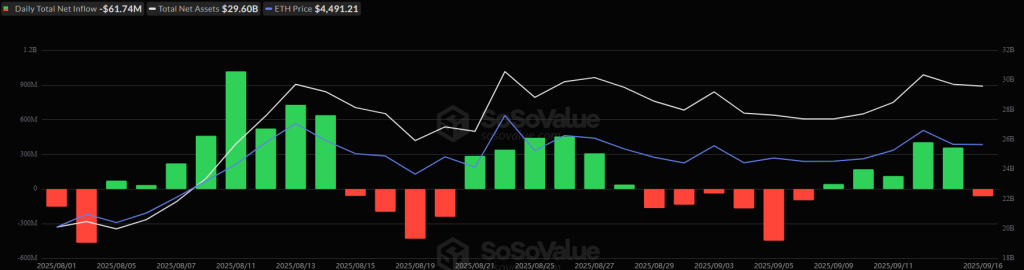

The US ETH ETFs, however, broke the inflow streak, recording $61.74 million in outflows on 16 September. Two of the nine funds saw inflows, and one saw outflows. The total net inflow is now at $13.66 billion.

Bitwise took in $6.75 million, while BlackRock and Fidelity lost $20.34 million and $48.15 million, respectively.

Meanwhile, Spanish banking giant Banco Santander has begun offering retail crypto trading through its online bank Openbank. Its customers in Germany can now buy and sell Bitcoin, Ether, Litecoin, Polygon, and Cardano, with more coins in the pipeline.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has increased over the past day, while the stock market decreased on its previous day of trading. By the closing time on Tuesday, the S&P 500 was down by 0.13%, the Nasdaq-100 decreased by 0.08%, and the Dow Jones Industrial Average fell 0.27%. Investors remain confident that the US Federal Reserve will announce interest rate cuts today, for the first time this year.

- Is this rally sustainable?

The markets will likely make further moves following today’s US Fed policy meeting, but since many analysts argue that the rate cut news has already been priced in, it will be interesting to see how the prices will move and for how long. We may see a brief rally, for example, before an additional pullback and consolidation period. Some expect an extended rally in the long term.

The post Why Is Crypto Up Today? – September 17, 2025 appeared first on Cryptonews.

Banco Santander’s Openbank has launched retail crypto trading in Germany with five tokens, with plans to bring the service to Spain next.

Banco Santander’s Openbank has launched retail crypto trading in Germany with five tokens, with plans to bring the service to Spain next.